401k contribution match calculator

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Now a 401K contribution is determined by taking a percentage of your income rather than an amount of the income.

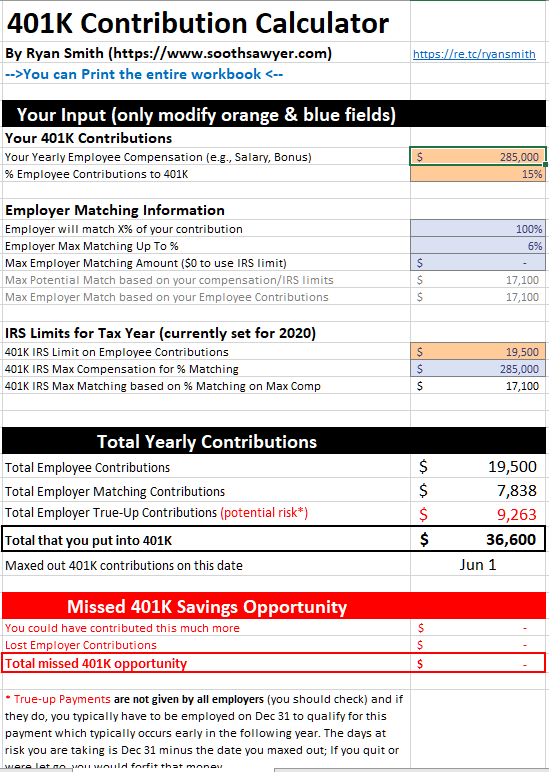

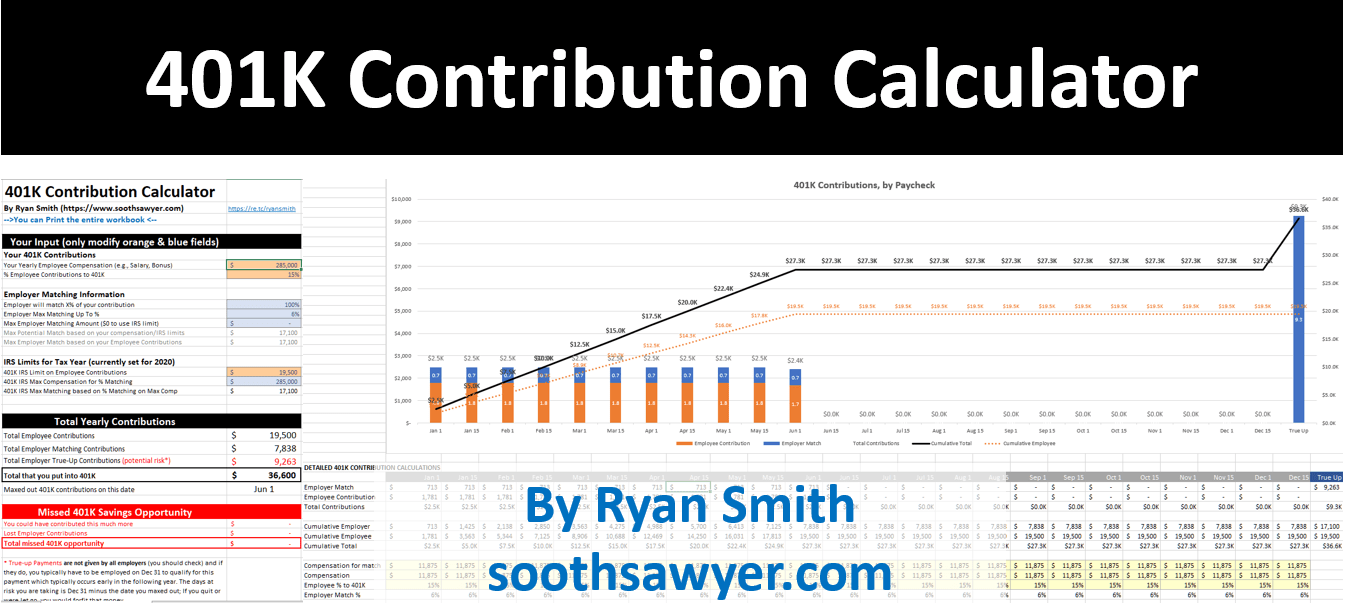

401k Employee Contribution Calculator Soothsawyer

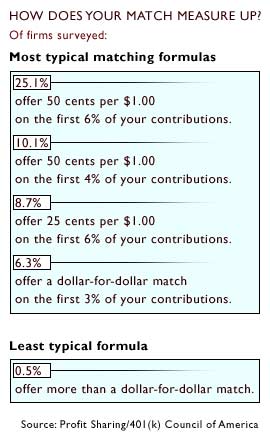

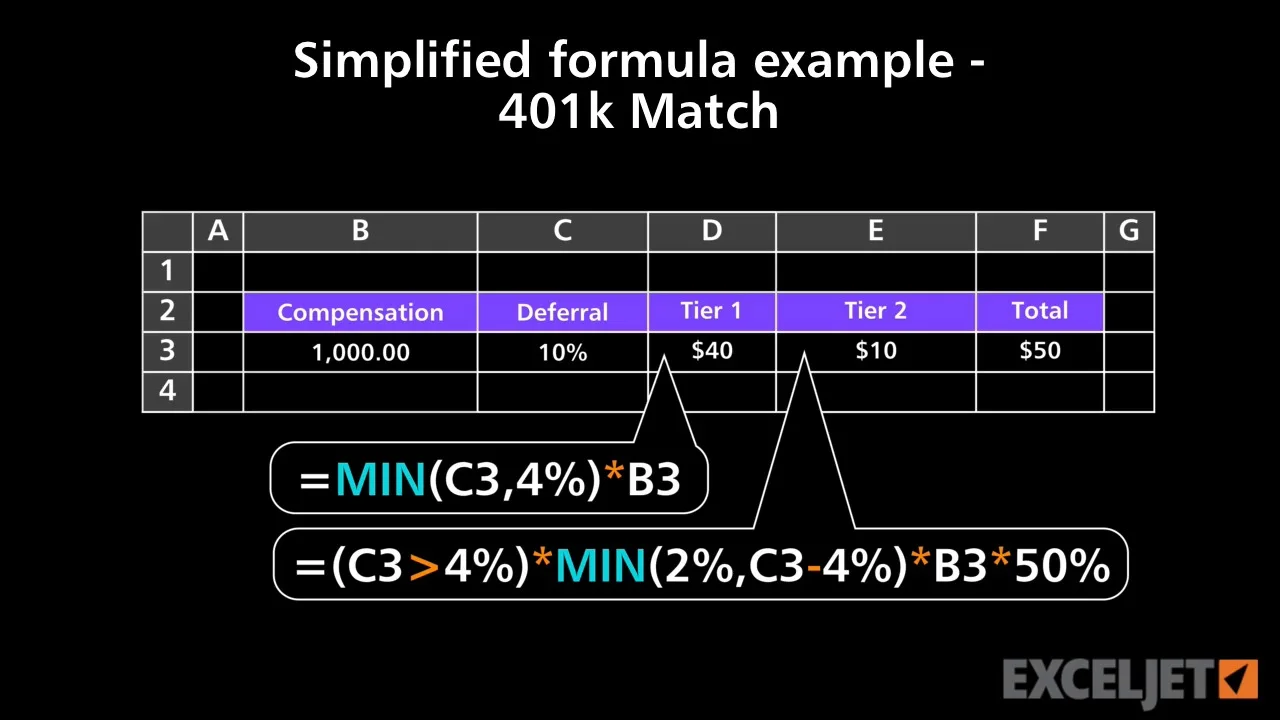

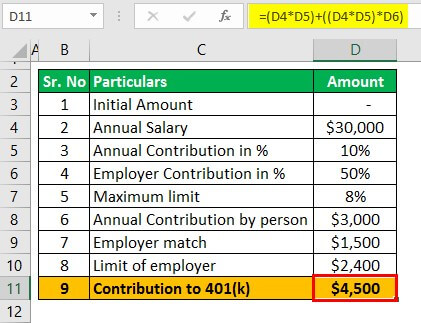

The most common involves matching 050 of every dollar the employee contributes up to a set percentage of employee contributions sometimes called a partial.

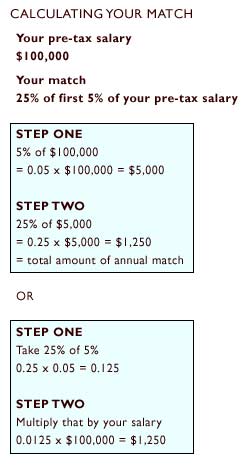

. NerdWallets 401k retirement calculator estimates what your 401k balance will be at retirement by factoring in your contributions employer matching dollars your expected. Your employer match is 100 up to a maximum of 4. If this employee earned 60000 the employer would contribute a maximum of 1800 to the.

Compare 2022s Best Gold IRAs from Top Providers. If the employee wants to withhold more than 4 percent of gross wages the benefit will match 50 percent up to 4 percent of the gross wages. The Roth 401 k allows contributions.

The IRS also limits the total contributions to 401k accounts. Ad Discover The Benefits Of A Traditional IRA. A 401k can be one of your best tools for creating a secure retirement.

If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit. As of January 2006 there is a new type of 401 k -- the Roth 401 k. A 401 k can be an effective retirement tool.

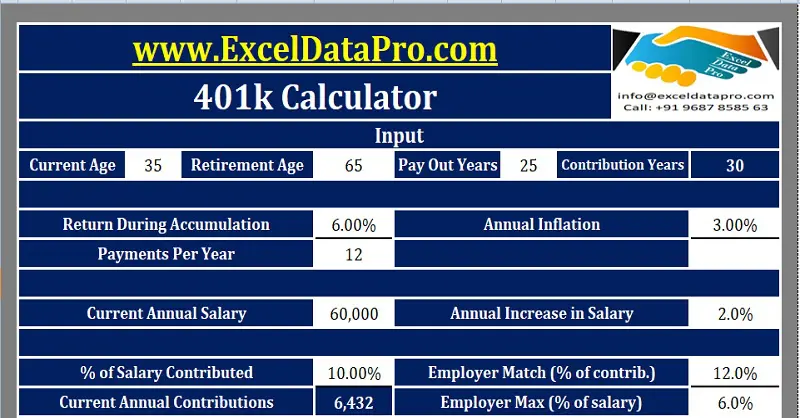

401k contribution calculator parameters The parameters required to calculate a 401k contribution are as follows. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Ad Ensure the Retirement Youve Always Visualized.

If you contribute that much to your 401 your employer contributes half the amount 1500 of free money as a. Discover Which Retirement Options Align with Your Financial Needs. Your 401k plan account might be your best tool for creating a secure retirement.

Employers usually set a limit on their match either as a certain dollar amount or as a percentage of the employees salary. A One-Stop Option That Fits Your Retirement Timeline. Many employers choose to match you 401k contributions up to certain limits.

It provides you with two important advantages. That means your employer also contributes money to your 401k account as a job benefit. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

It provides you with two important advantages. A 401 k can be one of your best tools for creating a secure retirement. The benefit will be calculated as.

Find a Dedicated Financial Advisor Now. In other words if you want to contribute 100month and. You expect your annual before-tax rate of return on your 401 k to be 5.

The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and. You only pay taxes on contributions and. Learn About 2021 Contribution Limits Today.

Your current before-tax 401 k plan. In this field you enter your current age. For example an employer may match up to 3 of an employees contribution to their 401k.

The 401k contribution calculator exactly as you see it above is 100 free for you to use. The employer match helps you accelerate your retirement contributions. The value of your 401k at retirement is a function of how much you contribute the matching provided by your employer and the appreciation of your 401k assets.

Calculate your earnings and more. This federal 401k calculator helps you plan for the future. Many employees are not taking full advantage of their employers matching contributions.

First all contributions and earnings to your 401k are tax-deferred. First all contributions and earnings to your 401 k are tax deferred. Reviews Trusted by Over 20000000.

So if you make 50000 per year 6 of your salary is 3000. Estimated percent rate of return. For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to.

401k Employee Contribution Calculator Soothsawyer

401 K Plan What Is A 401 K And How Does It Work

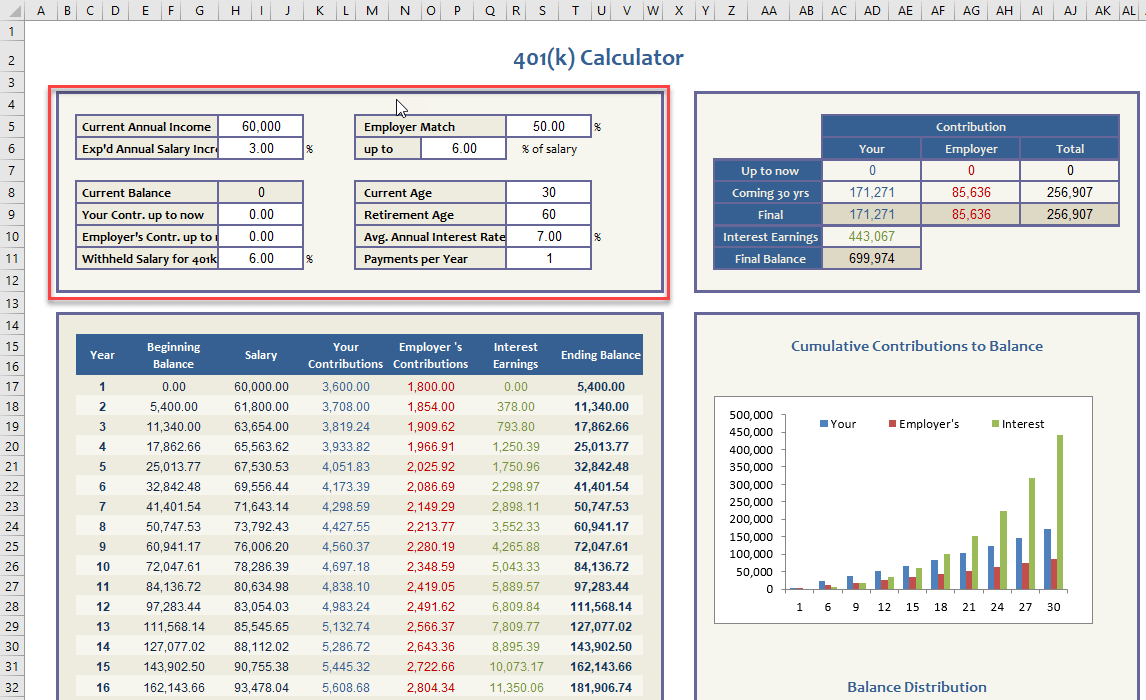

Customizable 401k Calculator And Retirement Analysis Template

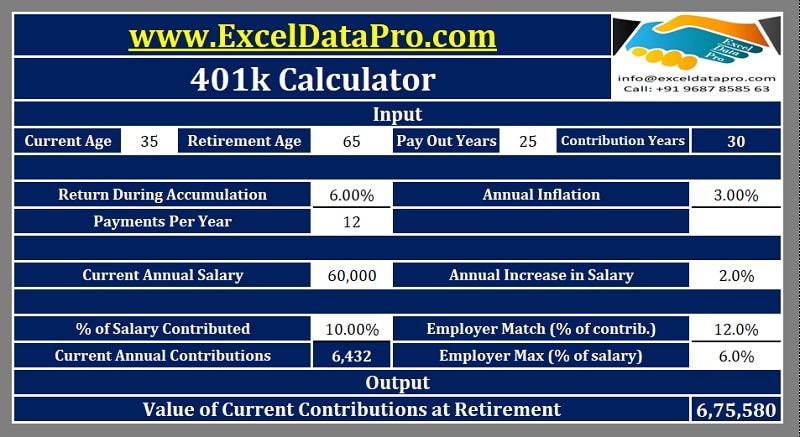

Download 401k Calculator Excel Template Exceldatapro

What Is A 401 K Match Onplane Financial Advisors

Free 401k Calculator For Excel Calculate Your 401k Savings

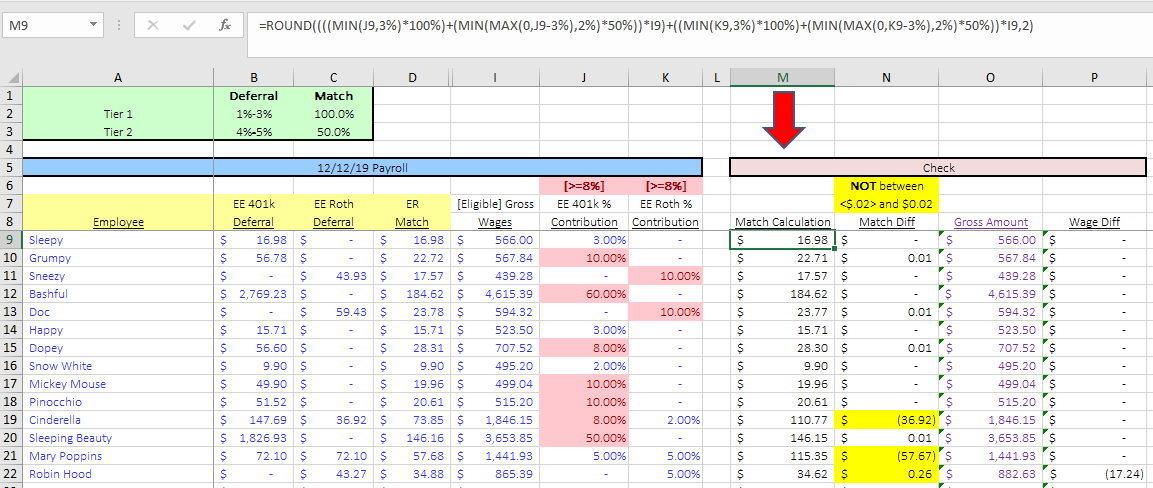

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

401k Calculator

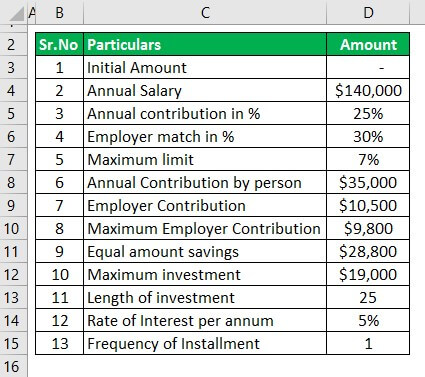

401k Contribution Calculator Step By Step Guide With Examples

Doing The Math On Your 401 K Match Sep 29 2000

Retirement Services 401 K Calculator

Excel 401 K Value Estimation Youtube

401 K Calculator See What You Ll Have Saved Dqydj

Excel Tutorial Simplified Formula Example 401k Match

Doing The Math On Your 401 K Match Sep 29 2000

Download 401k Calculator Excel Template Exceldatapro

401k Contribution Calculator Step By Step Guide With Examples